Not known Factual Statements About Summitpath Llp

Not known Factual Statements About Summitpath Llp

Blog Article

How Summitpath Llp can Save You Time, Stress, and Money.

Table of ContentsSome Of Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is DiscussingThe 9-Second Trick For Summitpath LlpLittle Known Questions About Summitpath Llp.Summitpath Llp Things To Know Before You Get ThisEverything about Summitpath Llp

25th Percentile 90000 The candidate has little or no prior experience in the position and is still developing relevant abilities. 50th Percentile 103000 The candidate has an average degree of experience and has a lot of the needed skills. 75th Percentile 115000 The candidate has above-average experience, has most or all the essential abilities and may have been experts credentials.Specializes in a certain financial location within a larger company framework. Important for the everyday financial wellness and compliance of the firm. Important for critical financial choices that affect the entire firm's future.

Contributes to high-level critical decisions, influencing the firm's direction and financial methods. Generally reports directly to the chief executive officer or the proprietor, ensuring they are notified of the monetary standing. May record to financial supervisors or CFOs, with duties including stakeholder reporting. Straight influences the company's monetary effectiveness and conformity, crucial for survival and growth.

The Facts About Summitpath Llp Revealed

An elderly financial accountant in these sectors could likewise look after cost control and economic planning, adding to critical decisions. Furthermore, the adoption of crossbreed job designs has actually enabled these experts to execute conserve job features from another location, balancing on-site and off-site obligations properly. Understanding these distinctions is important for a money supervisor to effectively assist their team and maximize monetary operations within the sector.

An effective company accounting professional mixes technical accountancy skills with strong personal attributes. Efficiency in audit software application and tools.

The smart Trick of Summitpath Llp That Nobody is Talking About

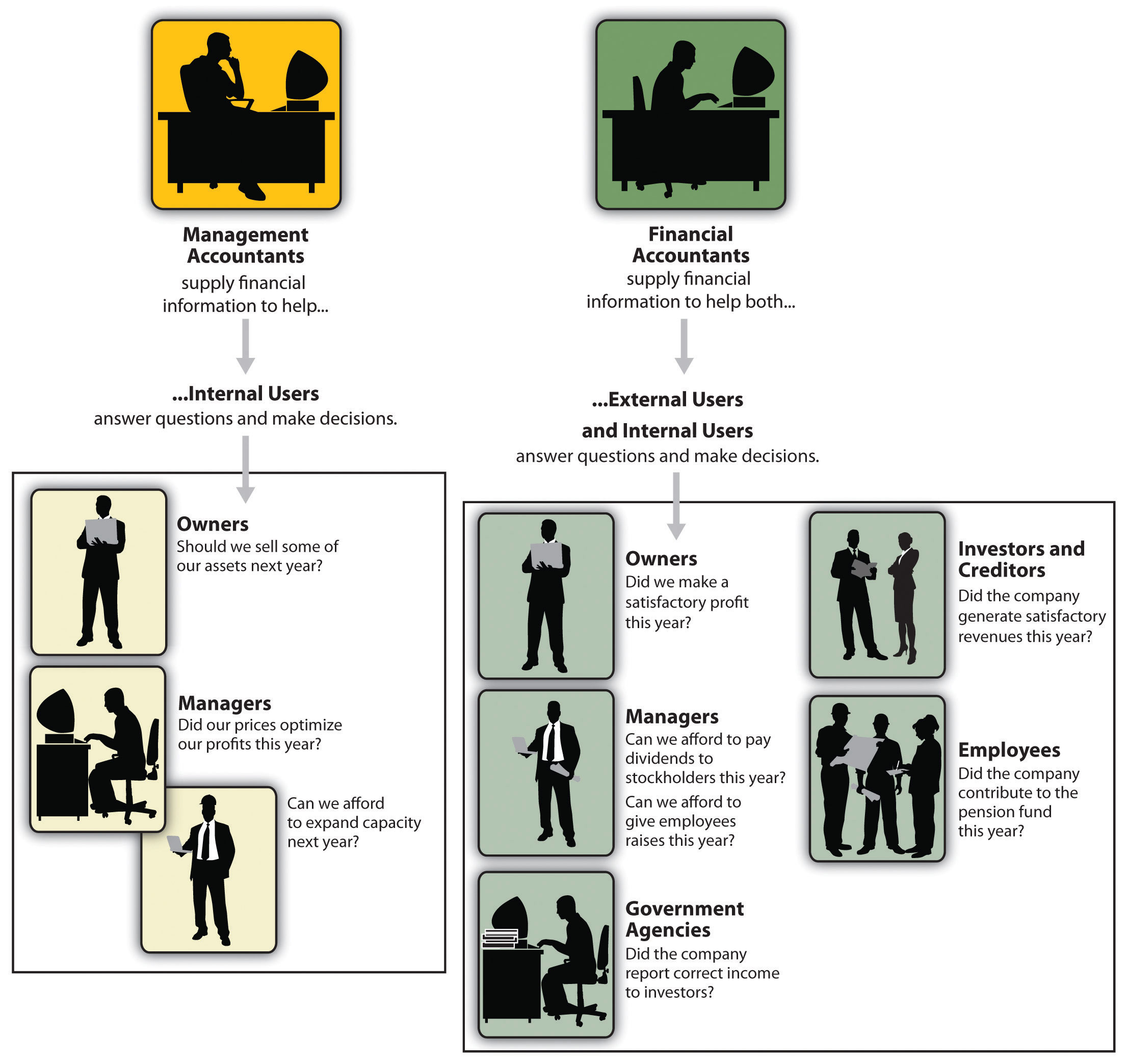

An accountant's job enables a business to properly track income, expenditures and various other data. Organizations likewise make use of the info to assess their economic health and wellness and make financial estimates crucial to investors.

She stated, it's not that simple: "What has actually happened in the last 5 to seven years is currently we have to educate our students to acknowledge and know what the computer system is doing behind the scenes. On the job, accounting professionals: Check out economic declarations to guarantee their accuracy Make certain that statements and records comply with legislations and regulations Compute tax obligations owed, prepare tax returns and guarantee punctual repayment Inspect account publications and accountancy systems to make sure they're up to date Arrange and keep monetary records Make best-practices referrals to monitoring Suggest means to decrease costs, boost earnings and boost earnings Supply bookkeeping services for businesses and people A fondness for numbers is critical for an effective accounting professional, however so are strong communication abilities.

You'll require to comprehend exactly how organizations run, both in basic and the certain operations of your business. Deciphering financial details can be like a challenge in some cases, and having the abilityand desireto evaluate and solve troubles is an excellent possession.

Improvement in the field can take several kinds. Entry-level accounting professionals may see their duties boost with every year of practice, and this might qualify them to move right into monitoring positions at greater incomes. Accounts in elderly manager, leadership or exec roles usually will need a master's level in audit or a master's of service management (MBA) with an emphasis on audit.

9 Simple Techniques For Summitpath Llp

Here is a sampling of specializeds they can pursue: Help individuals make choices about their money. This can include advising them on tax legislations, financial investments and retired life planning. Keep sensitive monetary details personal, frequently collaborating with IT specialists to protect innovation networks and stop security breaches. Identify the value of possessions, with the evaluations used for financial filings or sale of the assets.

Monitoring accountants frequently begin as expense accountants or jr interior auditors. They can advance to audit manager, primary cost accounting professional, budget plan director or supervisor of internal auditing.

Excitement About Summitpath Llp

Advancement in the area can take lots of kinds.

Keep delicate financial details confidential, often working with IT specialists to safeguard modern technology networks and click for source avoid protection breaches. Identify the worth of assets, with the appraisals made use of for financial filings or sale of the possessions.

Administration accountants typically begin as price accounting professionals or jr internal auditors. They can advance to accountancy supervisor, primary price accountant, budget plan director or manager of interior bookkeeping.

There are numerous accounting levels. The most affordable, an associate degree in bookkeeping, will certainly certify you for clerical duties under an accounting professional. There are 5 usual kinds of accounting professionals. For these duties, you'll require at the very least a bachelor's level and to come to be a qualified public account (CERTIFIED PUBLIC ACCOUNTANT), a credential that you can gain after you finish your level.

About Summitpath Llp

Advancement in the area can take several types. Entry-level accountants might see their duties raise with annually of method, and this may qualify them to relocate right into administration positions at greater salaries. Accounts in elderly manager, management or exec roles usually will need a master's level in bookkeeping or a master's of business management (MBA) with a focus on audit.

Maintain sensitive monetary info personal, typically functioning with IT experts to shield modern technology networks and stop security breaches. Determine the worth of assets, with the assessments utilized for financial filings or sale of the assets.

Administration accounting professionals frequently begin as cost accountants or junior interior auditors. They can progress to audit supervisor, chief expense accountant, budget director or manager of internal bookkeeping.

, will certify you for clerical roles under an accounting professional. There are 5 common kinds of accountants. (CPA), a credential that you can make after you complete your level - outsourcing bookkeeping.

Report this page